The Risks Associated with Using Zelle Payment Service & How to Avoid Being a Victim

People have been using PayPal and other services for quite some time to send money to not just friends and family members, but also to purchase products online. The service, however, is not free. PayPal charges a fee for its service, which is a set percentage of the amount that’s transferred. Venmo (a PayPal service), Square Cash, and Popmoney are some of the other services that have been around for years and offer ways to transfer funds electronically.

In June 2017, Early Warning Services, LLC launched a digital payment system called Zelle. Early Warning Services is owned by several banks, including JP Morgan Chase, Bank of America, Citibank, Wells Fargo, Capital One, US Bank, PNC Bank, and BB&T Bank. The purpose of the Zelle service is to allow people in the United States electronically transfer funds from their bank to someone else’s bank using either a mobile app or their bank’s website. The funds are transferred quickly and there is no fee for the service. That sounds wonderful. So, what’s the catch? In this article, I am going to share some of the issues that has made Zelle a security risk for people.

Who Likes to Use Zelle?

Banks and their customers are loving the ease and speed with which the money can be transferred between banks. The hackers and scammers are loving the ease with which they can con people and steal their money because Zelle offers no fraud protection. Luckily, banks have a limit on how much money can be transferred. Each bank sets its own limits. For example, some banks allow transferring up to $2,500 per day and no more than $4,000 in a month, while others allow $2,000 per day and as much as $16,000 per month. Unfortunately, these limits don’t help victims of scams who buy concert tickets or various products from online sellers. Because the banks do not offer any fraud protection to people who use Zelle payment system, people can get scammed for up to $16,000 a month, depending on where they bank.

| Zelle is probably one of the easiest methods to scam people out of money on the Internet. |

What are the Risks Associated with Using Zelle?

Because so many big banks offer Zelle payment service, most Americans naturally assume that Zelle is safe. After all there’s hardly an American who hasn’t banked at one of these giant banks at one time or another in their life. I am talking about banks such as Bank of America, Wells Fargo, Citibank, and Capital One. These are all household names. However, because of the way the Zelle service payment works, these big-name banks can’t offer you any protection at all if you initiate a transfer to another Zelle customer. According to Zelle’s security page, you are supposed to use Zelle to “Only send money to friends, family and others you trust.” You have to be careful because “once you authorize a payment to be sent, you can’t cancel it if the recipient is already enrolled in Zelle.” You can only cancel a payment if the recipient is not enrolled in Zelle and if you stop a payment that’s in progress, you are likely to be charged a fee. My bank charges a $25 Stop Payment fee.

| If a person is enrolled in Zelle, there’s no way for you to cancel a processed payment. It’s exactly like sending them cash. |

As far as Zelle is concerned, they are never at fault and therefore you can’t make a claim against them. Unlike, PayPal and eBay that are known for protecting their customers’ purchases, Zelle won’t be able to help you. If you buy the wrong product, it’s your fault so you have no claim. If you buy the correct product, but receive the wrong product, you have no case. If you send money and don’t get your product at all, it’s your fault. If you make a typo and accidentally send the money to the wrong person, it falls under the category “too bad.” With Zelle, you have zero margin for error because you have no purchase protection of any kind. That’s why it’s best to use it only to send money to people you know and trust and for small amounts. To Zelle’s credit, they have made this very clear (see this blog post). They have warned people about most of the things I have pointed out in this article. They don’t try to trick the consumers. The challenge is that transferring money is so easy with Zelle that even a single mistake can be costly. Furthermore, because the digital transactions can take place within seconds, banks are unable to stop illicit transfers.

What is Zelle Good For?

Zelle is only good for sending small amounts of money to someone you know and trust, like your friends and family members. According to Lou Anne Alexander, the group president of payment solutions at Early Warning Services, the company that launched Zelle, “Use Zelle to split the bill with your friends for lunch…But never use it for any sizable transaction, or with anyone you don’t know.” You should only use Zelle to send money that you are okay with risking, whatever that amount might be. Also, remember that you can’t afford to make a typo and risk sending money to the wrong email or phone number. You are not dealing with your credit card company here, which offers fraud protection and dispute resolution. No wonder people have compared Zelle transactions to vaporware.

| With Zelle there is no Purchase Protection, no Fraud Protection, and no Dispute Resolution. If you send money and get scammed, it’s your fault. |

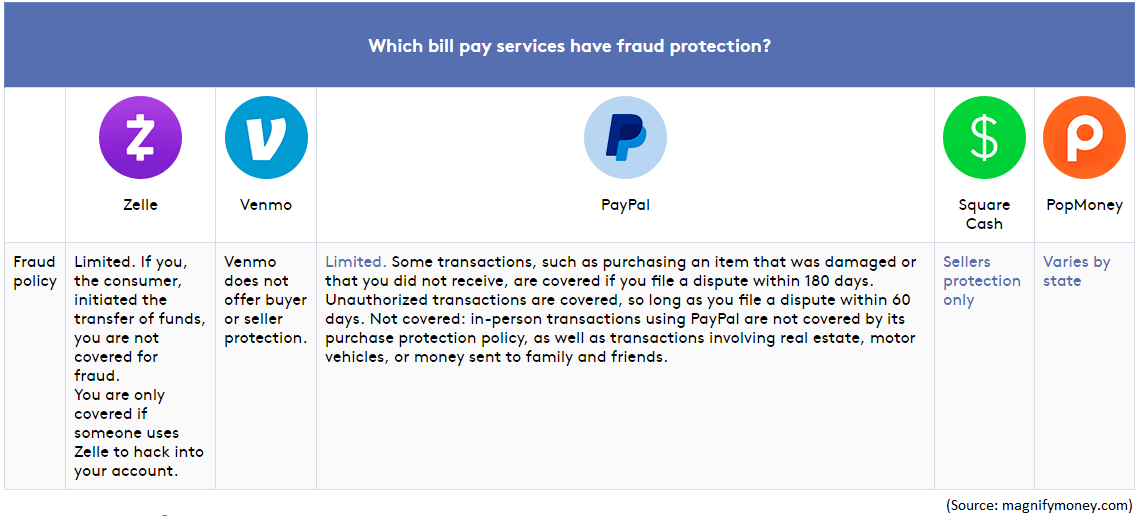

Here’s a comparison of fraud protection offered by various payment services. This will give you an idea where Zelle stands. Click to enlarge the image.

Consumer Reports Score

The editors at Consumer Reports tested five popular payment services for its data privacy and payment authentication practices in 2018. Apple had an outstanding overall score of 76 out of 100. Zelle was last with an overall score of 50. It did poorly on both data privacy and security practices. According to NBC News, the Consumer Report “criticized the Zelle app for not having a way to keep users from accidentally sending money to the wrong person, if they mistype a phone number.” The NBC News article was published in August 2018. Zelle responded by saying that “by the end of October, that confirmation step would be added to the app and used by all financial institutions that offer the service.”

Here are the Consumer Reports test results.

| Payment Service | Test Score Out of 100 |

| Apple | 76 |

| Venmo | 69 |

| Square Cash’s App | 64 |

| Facebook P2P Payment | 63 |

| Zelle | 50 |

Fraud and Hacking Incidents

There are lots of incidents of fraud associated with the use of Zelle and there have been cases where hackers have literally cleaned out their victims’ bank accounts. According to the New York Times, Genevieve Gimbert, a partner in PwC’s financial crimes unit said, “I know of one bank that was experiencing a 90 percent fraud rate on Zelle transactions, which is insane.” Because with Zelle the transactions take place within seconds, the banks are facing difficulty stopping the transactions in process or reversing the illegal transfers.

Here are a few examples and stories of victims being hacked and the incidents of fraud taking place through Zelle. You will also find Zelle transfer experiences shared by the readers of this blog in the comments section at the end of this article.

- New York Times: Zelle, the Banks’ Answer to Venmo, Proves Vulnerable to Fraud

- NBC Dallas: Consumers Say Their Bank Accounts Were Hacked Through Zelle

- NBC Chicago: Hackers Easily Drain Cash from Popular Banking App, Experts Warn

- NBC Miami: Consumers Hit with Fraudulent Zelle Transfers

- ABC13.com: $1,000 disappears from aging woman’s bank through Zelle

- TechCrunch: Zelle users are finding out the hard way there’s no fraud protection

- Experian: Here’s What You Need to Know About Zelle

I did some research to find out the net worth of the eight banks that own Early Warning Services, LLC (creator of Zelle). Here’s the breakdown of their total worth of $10,182 billion.

| Bank Name | Total Assets |

| J.P. Morgan Chase Bank | $2,615 billion |

| Bank of America | $2,338 billion |

| Citi Bank | $1,925 billion |

| Wells Fargo Bank | $1,872 billion |

| US Bank | $464 billion |

| PNC Bank | $380 billion |

| Capital One Bank | $362 billion |

| BB&T Bank | $226 billion |

| Total | $10,182 billion (or $10.182 trillion) |

You would imagine that with the financial power of $10.182 trillion these banks could afford to hire developers who can create a system that doesn’t have the issues that Zelle has faced for the past year and a half. Unfortunately, that’s not the case.

How to Avoid Being a Victim

To avoid becoming a victim of fraud, follow the guidelines provided by Zelle and my recommendations in this article. People run into problems because they don’t bother reading their bank’s or Zelle’s guidelines. Keep in mind that the Zelle payment system is designed only to send small amounts of money to someone you know and trust, like your friends and family members. Don’t use Zelle to pay strangers on Craigslist or other online services. With Zelle people have been scammed not only as buyers, but also as sellers. If you follow Zelle’s guidelines, you are likely to stay safe. If you don’t, chances of any bank or law enforcement authority helping you are slim.

Zelle Test Run

The Zelle app allows you to add people’s name, email address, and mobile phone number. If you want to send money to someone you KNOW and TRUST, follow these steps to do a test run before sending funds. This will almost eliminate your chances of inadvertently sending funds to the wrong person.

- Log in to your bank account and create and register for Zelle service. This is very quick because your bank already has your email and phone number. You can always change the email or phone number you want to use with Zelle later.

- Carefully add the contact information of the recipient you trust (e.g., your friend) and verify that the contact information is correct. One typo could potentially cost you thousands of dollars.

- Send your friend the smallest amount your bank allows to transfer (e.g., $5.00).

- If your friend has an account, the funds will be transferred to her/his account right away. Otherwise, your friend will receive a notification from Zelle to register for their service to accept the transfer.

- Contact your friend by phone (do not use email) to verify the transfer was successful. Some banks will tell you that it can take up to three days for the first transfer, but the future transfers are within minutes. However, don’t be surprised if even the first transfer only takes a couple of minutes.

NOTE: This confirms that you added your friend’s email and/or mobile number correctly and you don’t need to worry about making a typo and sending money to the wrong person in the future. - Ask your friend to add your contact information in Zelle and then send $5.00 to you.

- You should receive the funds in minutes. This proves that your friend added your contact information correctly. It also proves that you followed my test run instructions successfully and didn’t lose any money in the process :-).

If you repeat this test run for every individual that you want to send/receive money, you can rest assured that you’ve almost eliminated the risk of sending money to the wrong person. And if you only send/receive money to/from people you know and trust, you’ve completely eliminated the risk of getting scammed by a stranger.

Article Update: March 17, 2022

I originally published this article on April 1, 2019. Much has changed since then and you can even use Zelle for business now. However, this article only applies to Zelle for personal use.

As far as the technology is concerned, funds transfer with Zelle have been, and still are, safer than some other popular applications, such as Venmo, Cash App, etc. After all, the application was developed by some of the top banks in the United States. Zelle encrypts data and the transactions have been always secure.

One of the big complaints about Zelle has been its lack of payment protection. If a user makes a mistake, the penalty is severe. There are legitimate reasons why banks can’t provide payment protection to Zelle users. Some of the reasons have to do with the way Zelle is integrated with the banking networks. For example, because funds are transferred electronically in seconds, banks can’t easily interrupt the transfer due to the nature of electronic transactions. Once the funds are in someone’s bank, reversing the funds require time-consuming investigation and of course there are legal ramifications that the bank is required to consider. With 1.8 billion payments through the Zelle network in 2021, it’s easy to understand why banks can’t get bogged down in investigating user errors or offer payment protection for payments that are essentially cash transactions. However, I don’t think that’s still a good excuse for Early Warning Services, LLC to not add some kind of protection for its customers. They’re backed by banks whose combined net worth is more than $10 billion. I am sure they can come up with a good solution.

Here’s one idea. Currently, Zelle either uses recipient’s phone number or the email for verification purposes. How about requiring Zelle to verify both the phone number and the email of the recipient in the transfer request from the sender? This will provide a very high level of verification method because the two must be matched on both ends (sender and recipient). The chances of the funds being delivered to the wrong person would be extremely small. This type of solution can provide the necessary protection for the Zelle users. This is just one idea. I am sure there are other ways to at least minimize, or completely eliminate, basic user errors like typos and ensure the funds always end up in the intended recipient’s bank.

At the time Zelle was launched, its advertising caused some confusion among the users. Banks made claims in TV commercials such as, “You can send money safely cause that’s what it’s for / It’s backed by the banks so you know it’s secure.” The consumers thought it meant they could safely transfer funds because they were covered by their bank. However, that wasn’t the case. The Federal Regulation E, which deals with electronic transactions, provides some protection for consumers who transfer funds electronically. Even though the Federal Reserve’s Regulation E applies to several types of transactions, checks or wire transfers are not covered. Another thing of interest is the definition of the word fraud. As 13newsnow.com points out, Zelle claims that although “Consumers are not liable for unauthorized activity on their accounts,” Zelle’s definition of fraud doesn’t cover payments initiated by a consumer.

Things were rather messy for a couple of years after Zelle was introduced, so the banks decided to do a better job of user education. Today Zelle is extremely popular. According to PYMTS.com, “Since its launch in 2017, Zelle has rapidly grown to become the largest U.S. P2P payments network by total payments value sent, with payment flows that are now twice the size of the next largest standalone competitor.” In fact, in 2021 Zelle users transferred a whopping $490 billion.

Does that mean that the issues I raised in my article are no longer applicable today? No, not much has changed in terms of the way Zelle works. If users don’t pay attention to Zelle’s guidelines and the “test run” I discussed above in the section How to Avoid Being a Victim in this article, they will continue to be at risk of losing money. It’s all about understanding the risks associated with Zelle and educating yourself.

If you want to use Zelle for making or receiving payments, follow these best practices.

Best Practices for Using Zelle

- Use strong password and multifactor authentication to secure the Zelle app.

- Use a secure web browser like Microsoft Edge to access your bank’s website.

- Always go through a test run before making the first Zelle payment to someone.

- Use Zelle for sending only small amount of funds. I would describe small as amount you can easily afford to lose.

- Only send funds to the people you Know and Trust. (e.g., your family, friends, neighbors, coworkers, babysitter, etc.).

- Don’t use Zelle to purchase anything from strangers on Craigslist or other websites.

- Remember that sending money with Zelle is like sending someone cash. Your cash payment cannot be canceled and Zelle doesn’t tax money you receive or report transactions to the IRS.

- Know that Zelle payments can only be canceled if the recipient is not enrolled in Zelle and if you stop a payment that’s in progress, you are likely to be charged a fee.

- Remember that Zelle is incapable of forgiving typos. If you incorrectly typed the recipient’s phone number or email, your cash probably ended up with a stranger and you shouldn’t expect it back.

- Be aware of payment scams and remember that unlike a credit card, Zelle does not offer any payment protection.

- Sign up for text or email alerts from your bank when funds are transferred to or from your account. If you contact your bank as soon as you discover a suspicious transaction, they might be able to cancel your transfer before it’s too late.

- Don’t use Zelle until you’ve read this article on Zelle’s blog: Sending Money Safely with Zelle.

| Thanks for reading my article. If you are interested in IT consulting & training services, please reach out to me. Visit ZubairAlexander.com for information on my professional background. |

Copyright © 2019 SeattlePro Enterprises, LLC. All rights reserved.

My Fiance sent $2000.00 to her landlord whose last name was Adams, it went to another contact With the name Adam. She is apparently out $2,000.00 ….DO NOT USE ZELLE!!!!!!!!! YOU WILL LOSE YOUR $$$$$ AND HAVE NO RECOURSE!!!!!

@Mike: I am sorry to hear your fiancé lost $2,000.00. If people verify the accuracy of the recipient’s account by doing a test deposit of a small amount, as I explained in this article, they can avoid unpleasant surprises of this nature.

My sister sent me $4,000 and there was a typo in the email and the person accepted. I’m trying to figure out if I can file criminal charges against this person. This person that accepted is a nurse and we have found out where she works. Would it help the case if we sent law enforcement officers to where they worked?

@Lauren: It’s always a good idea to contact an attorney for advice on legal matters. I am not an attorney so I can’t give you any legal advice. However, I do know that a lot of people in your situation would contact the law enforcement for help.